Ethiopia’s rapid adoption of agricultural mechanization, albeit from a low base, has been of particular interest over the last few years. With the economy demonstrating double digit growth rates, the agricultural sector has also displayed significant modernization and increasing yields, alongside increasing wages and costs of animal traction. However, despite these overt changes, there exists little recent empirical evidence on mechanization and its adoption. Furthermore, there continues a growing interest among policy makers because of climate change and further potential modernization of the agricultural sector.

Guush Berhane, Mekdim Dereje, Bart Minten and Seneshaw Tamru from ESSP presented preliminary research findings at the Ethiopian Development Research Institute (EDRI) on 17nd February 2017. Their research cited agricultural transformation over recent years and the impact such has had on the demand and supply of agricultural machinery and the provision of services. Using qualitative and quantitative data of imports, households and socio-economic survey information, this research explored changes from two angles – the demand side and the supply side of agricultural machinery. Click here for the presentation.

The Demand Side

Overall, the data analysis revealed a range of differences in mechanization across zones in Ethiopia based on farm activities (i.e. plowing and threshing) and the size of farms. In land preparation, an average 78.8 percent of plots were prepared by animals, compared to 0.7 percent prepared by machine; and with threshing, almost 50 percent of plots were worked manually, 47.9 percent with animals, and only 0.8 by machines. In addition, the research explored mechanization of different crop types, finding wheat as the dominant crop in which machinery is used in Ethiopia, albeit still low compared to Africa as a whole.

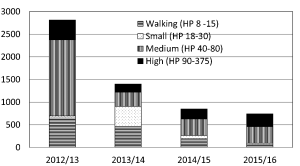

Over time, the research shows a huge change in imports of agricultural machinery - notably tractors - up until 2014. These tractor imports were mostly driven by the expansion of the AAMI (Adama Agricultural Machinery Industry) – Ethiopia’s main importer of tractors. However, since then, the AAMI has experienced a rapid decline in sales of all types of tractor (Figure 1). Yet, there has been a rapid increase in combine-harvester imports over this same period which continue to grow.

Figure 1: Changes in tractor sales over time

Source: Authors’ calculations based on AAMI sales data

In Ethiopia, the research carried out shows strong spatial patterns in mechanization, concentrated largely in the Arsi/Bale area, Western Tigray and parts of Somali region. The reasons for this concentration of machinery in the south-east of the country could be attributed to the presence of commercial farms or generally larger smallholder farms, a history of interventions, higher rural wages, flat and stone-free terrain, and two harvests which add pressure to get the work done on time, hence the important use of machinery.

The Supply Side

With no manufacturers of combine-harvesters or tractors in the country, high taxation rates, and limited access to foreign exchange, these have all contributed to the hurdles encountered by farmers wishing to use modern machinery. The situation however, has alleviated slightly with greater priority from the government to improve mechanization and from the involvement of the private sector in dealerships. The research shows that 60 percent of tractors are owned by commercial farmers/state farms, with the remaining 40 percent owned by service providers. In the case of combine-harvesters, 90 percent are owned by service providers which play a massive role in delivering services to farmers – but this comes at a cost.

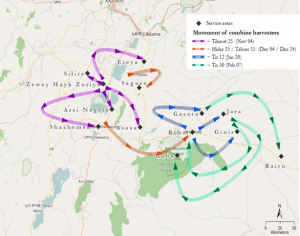

Typically, the cost of using a combine-harvester will depend on: the type of soil, yields, religion, temperature, the location of the farm and the slope of the land. Therefore, farmers’ decisions on whether it is profitable to engage in these services depend on this cost, as well as wage levels. To supply the region with appropriate mechanization services, this research identified the seasonal movement of combine-harvesters (see Figure 2). To cater for this task, brokers are used to coordinate the movements of machinery and to calculate the travel cost based on quintals of crop.

Figure 2: Seasonal movement of combine-harvesters

Seasonal change has less influence on the movement of tractors as these can be used for many farming applications, and hence needed longer in the same place. Furthermore, tractors are considerably cheaper than combine-harvesters, which means that some richer farmers might be able to purchase a tractor. Inevitably, the need for good maintenance and servicing is crucial to this service operation.

Mechanization and its Impact on Yields and Labor

For farmers, the productivity of the land is a primary concern; and so by introducing mechanization and the associated costs, this should illustrate clear financial benefits. This research explored how farmers adopt modern practices and engage with rental services, whether to do with land or farm labor, and the association (if any) with the use of mechanization.

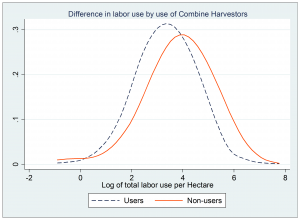

Figure 3: Difference in labor use of combine harvesters

From the analysis, yields seem to be affected during post-harvest activities from the use of combine-harvesters including: reduced losses in threshing and from animals consuming during work activities, losses in transport from the field to the threshing floor, as well as the potential loss from theft or untimely rain. However, the research also shows that yields are not different when using tractors.

Ethiopia is at an early stage in mechanization and the widespread effects are not yet obvious. However, the research has signified further impacts higher adoption levels could achieve in time.

Conclusions

The major findings of this research have shown that mechanization is low, but some important dynamics are changing the farming environment. For example, about a quarter of wheat production is harvested by combine-harvesters, and there is a speedy emergence of commercial service providers for plowing, harrowing and harvesting. This is having a large effect on labor productivity, although to date, there is no or little effect on yields.

For further upscaling, this research has identified three noteworthy points:

- Prices matter – access to credit and foreign exchange would open up channels for many investors in mechanization. Moreover, finding ways through which emerging model smallholders can have access to imported machines, or the potential affordable options on small machines for smallholders at reduced import duties, are still to be investigated.

- Maintenance and after-sale service matters – selling machines is not enough to provide a sustainable service to farmers. Skilled available mechanics and access to spare parts (especially if models change) are often issues which will improve as the mechanization markets grow.

- The role of the public sector – the private sector has considerably helped in the take-up of mechanization, but the public sector has an important role to play in capacity building and improving knowledge and awareness, as well as enabling suppliers of credit to provide easier access. Additionally, helping to develop appropriate technology for innovative machinery use will no doubt help with adoption.

A new ESSP Working Paper on this research will be available soon.

Please subscribe to receive regular updates on ESSP’s work.