ESSP and EDRI hosted its first conference on coffee in Addis Ababa on September 15, 2015 at the Hilton Hotel. The program appointed contributions from different aspects of the supply chain, and presented up-to-date research on this highly important sector in Ethiopia. Over 70 people attended from various levels of the coffee value chain.

This timely conference covered topics ranging from gender, food security, the ECX, quality, voluntary sustainably standards (VSS), export performance, and many others (see Figure 1 for details of topics covered). The complete coffee value chain was critically examined and discussed by leading experts in the field, culminating with an international perspective of the unexploited potential that exists in Ethiopia’s coffee industry.

Figure 1 – Topics covered during the Coffee Conference

The coffee industry has changed significantly over the last 10 years. As well as coffee being an important social aspect to Ethiopia’s culture, coffee exports from Ethiopia comprise 22 percent of the value of all exports. Many policy changes have impacted the coffee industry, including a large increase of extension agents in the field, creation of primary marketing centers for trading, the establishment of the ECX, as well as efforts to reduce hoarding of stocks by exporters. The data used in much of the research presented comes from a unique dataset collected from a primary survey conducted by ESSP/IFPRI. (see Ethiopia’s Coffee Sector Overview presentations)

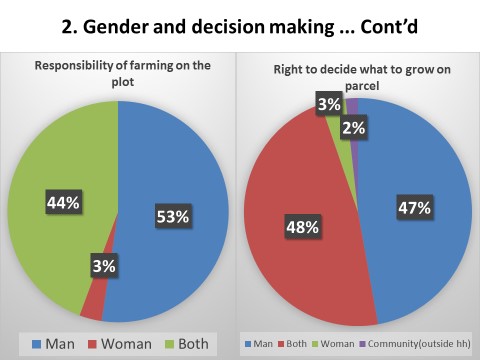

From an upstream perspective, presenters remarked on aspects that are having a major impact on coffee production, most notably the effect of climate change and disease becoming a bigger issue. Coffee quality is being encouraged by various practices through extension services, fortified by better marketing opportunities and options. Improving communications on prices, access to improved seedlings and trust invested in traders, have played a large part in changes upstream. What needs to be addressed is the imbalance of gender to enable women to participate more in coffee production activities. (see Upstream presentations)

Figure 2 – Gender and decision making (from slide in gender presentation)

At midstream level, the challenges have centered around washing coffee and the setup of wet mills, since washed coffee fetches a much higher price on international markets. Certification also is shown to raise the price of coffee, yet very little of this premium goes to the producers. The Ethiopia Coffee Exchange (ECX) has contributed to the functioning of the value chain, with an indication that farmers are in general more satisfied at the services provided by the ECX, such as in moisture and quantity testing, transactions and assessments. Notably, the export prices margins have not significantly increased after the ECX, but transparency seems to have improved from the perceptions of processors. Traceability remains an issue. (see Midstream presentations).

There are many factors that influence the quality and ultimately the price downstream. Observable quality measures, such as washing are easier to assess than those unobservable measures, such as geographic origin, and thus many producers are not being rewarded for such in local retail markets. VSS, geographical origin indicators, and washed coffee are found to be important determinants of quality premiums in export markets (see Downstream presentations).

Figure 3 – Quality and traceability (from Turello’s presentation)

Within the International context of coffee trade, quality comes high in the requirements. Turello stressed the importance of an integrated supply chain that builds close links between client and the exporting company, who in turn are closely in touch with the producers. By farmers’ informed participation in the value chain, the value of the coffee can improve.

Finally, in the closing session, John Mellor reflected on international experiences and implications for Ethiopia. He extracted some of the best practices to succeed in a very competitive market. But success comes at a price – the government needs to back recommendations and international best practices and assist with financing in order to compete effectively. Mellor reiterated that quality standards are most important to compete internationally, along with creating powerful producer organization backed by the government – all of which could make Ethiopia’s coffee market flourish.

To download any of the conference presentations, visit http://www.slideshare.net/essp2

Here are some of ESSP’s published works:

- The coffee export market: Structure and performance (Working Paper 66, Research Note 29) – provides an overview of the current state of the coffee market

- The coffee value chain on the move (Working Paper 76, Research Note 41) – focuses on the upstream aspects of coffee production

- Can agricultural traders be trusted? Evidence from the urban coffee markets (Working Paper 72, Research Note 36) – examines aspects of the coffee trade in Ethiopia - the perceptions and deceptions

- Who benefits from the rapidly increasing Voluntary Sustainability Standards (VSS)? (Working Paper 71, Research Note 35) – explores Coffee certification in Ethiopia and the controversial benefit this process has on smallholder farmers